Digital transformation has a remarkably huge impact on businesses. From one business to another and so on, and forth. Whatever industry you are into, the amazing change that it has brought will reevaluate how it enhances your daily work operations and employee productivity efficiently and effectively. Integration is an advantage and advancement to your business system that allows you to stay creative and ahead in the competition.

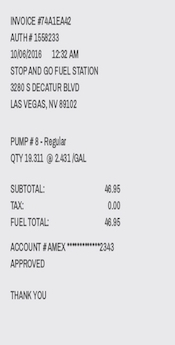

On receipts transformation, the difference goes further when it comes to accessibility, security, dependability, expeditious work result, and minimizing cost. The system is manageable on computers and smartphones and business owners can access it 24/7 anytime, anywhere. The access demand on your end is higher and you can always monitor your sales and expenses whenever you want, too.

Business accounting matters and using electronic receipts is much easier to generate financial reports, it also supports the book journal used when it comes to filing tax returns, payroll administration, and any other accounting-related tasks. You will be able to monitor the financial performance of your company, how much money you receive, and how much money you spent. The collaboration with your assigned accountant or assigned employee is more effortless and concluding to make any decision is definitely much brilliant and accurate. It is indeed that receipts bring significance to business accounting.

One of the exceptional software on digital receipt generators that many businesses used is ExpressExpense. A lot of routine tasks become automated to avoid repetitive tasks thereby saving more time to dedicate to other relevant tasks. This is not just for financial reports, your accountant portal, lawyers reference, or you as an owner, but also for your most valuable assets – your CUSTOMERS.

Customers are your strength to your business and giving them the best service they deserve is highly commendable. You have to present your brand way better than others, and customizing your receipts is one of the keys to making your company more recognizable. Customization of receipts creates more opportunities in marketing and advertising, such as email marketing as this is one of the cheapest, most convenient, and fastest ways to keep your customers stay informed about your products and/or services and can reach more potential customers. You have to always think outside the box if you want advancement, improvement and better income.

By taking advantage of this digital feature you are:

- allowing your customer to make use of their receipts more meaningful when it comes to recordkeeping purposes such as exchange/refund used, a receipt reimbursement, simple memorabilia, and the likes

- transforming the receipts into supporting legal document that describes all the data to be considered valid

- minimizing human or administrative errors to avoid possible serious customer complaints

- minimizing financial reports inaccuracy

- flagging suspicious accounts for audit purposes

The required amount of time you are committing to your business will noticeably be reduced. Likewise, with your employees, the work productivity will be intensified and everyone will find ways to make your business operations run better. In general, the eradication of errors is improving. This is a positive impact that any business is aiming for.

If you achieved great results on your starting point, it is a good sign that you are on the right track and will improve over time and this can lead to more customers and boost your company’s profits.