Why would anyone pay for paper receipts today? What real advantage do they have over electronic receipts?

We all know that the best way to resolve problems and issues in a business is to find out what went wrong and how it can be prevented in the future. Businesses may benefit from the use of a paper receipt to record transactions and provide customers with trustworthy records of their after-sales transactions. Paper receipts are not always what they seem to be. Paper receipts can be a pain, especially for tracking sales during the day and for storing data. Whether you are a business owner, a bookkeeper, or an accountant, you have probably been exposed to the issues of handling physical cash/paper receipts from customers. The key point here is that there are times that it can be an issue for everyone and in most cases, it is caused by three things:

(1) If receipts get faded or lost, there is no easy way to reconcile the data.

(2) In the case of a tax audit, as receipts are considered as supporting documents, they will not be accurate as printed details on thermal paper receipts cannot be stored for a long period.

(3) As a consequence, companies may experience cash flow problems.

Cash flow is what fuels business. If you are having issues you can use an online receipt maker that will help your business to collect payments faster and improve cash flow. Businesses now have the option of using electronic receipts. Companies that choose this method of payment can save a lot of time and money.

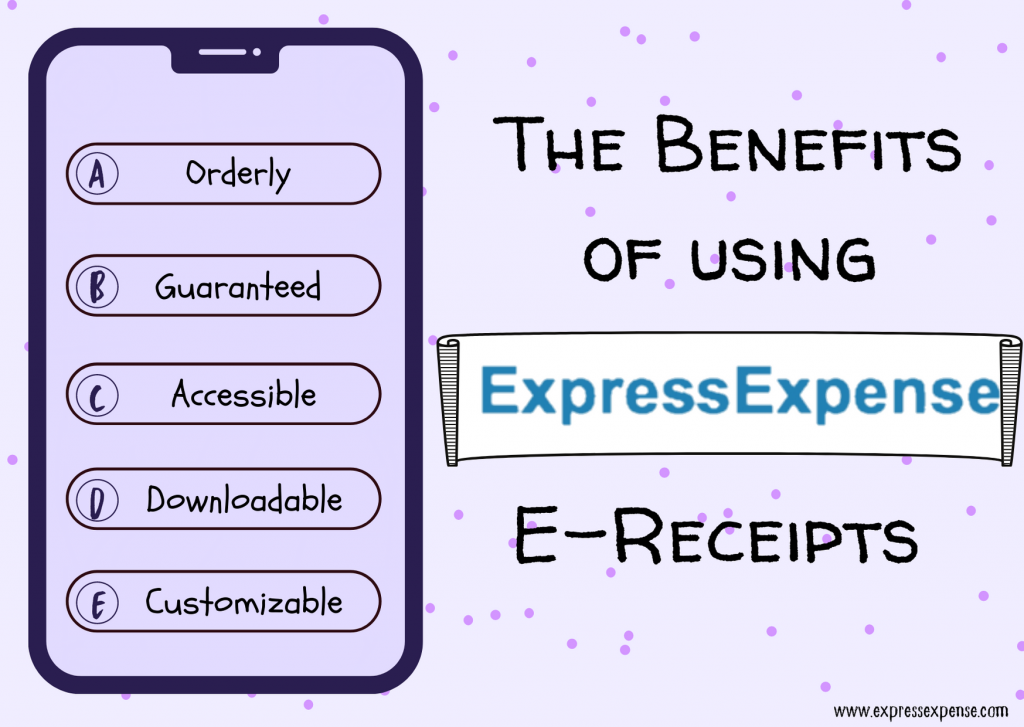

Businesses that choose to implement electronic receipts for their customers benefit from a variety of approaches. Here are some advantages:

- Businesses that choose to provide their customers with electronic receipts create an electronic trail of data for their clients such as purchase history.

- Electronic receipts benefit businesses by providing them with data about their customers’ behavior such as buying habits. When they usually purchase, do they purchase more during special events, sales, or the same behavior during an ordinary day?

- By being able to view the data, businesses are able to estimate the sales their customers make as well as the amount they spend.

- As a result, it helps businesses to gain additional income.

Paper receipts are an archaic system. The extra work, time, and cost are frustrating businesses, particularly Small and Medium Enterprises (SMEs). The only thing they’re keeping up with is frustration. In order to keep cash flowing towards your company’s finances, you must consider increasing the financial efficiency of your business operations.

As a business owner, you know how important it is to keep a record of each and every purchase made. Paper receipts management can add stress to your business and yes, digital receipt management brings more significance to business accounting, in marketing, to small business owners, and how it affects business in general. Knowing its significance will make your business stronger more than you are expecting it. This is one of the best cash flow management and you should TRY IT TODAY!