A comprehensive financial report is needed in any business you are into for better decision-making. Digitizing your receipt or accounting method used is beneficial to keep track of your business operations.

Two of the major reason why we keep receipts is to:

- record business expenses

- use as supporting documents for audit purposes

Before, paper receipts are used as a requirement whenever an employee needs to reimburse something that was bought for the use of the company. Or attach it with a petty cash voucher for validity and transparency. This approach leads the way to accuracy in calculating business expenses. Because of continuous great innovation in technology, digitizing business resources is now considered standard and more convenient in managing business reports and expenses. A digital receipt maker is a tool that is used by many business owners, particularly SMEs or what we call Small- to Midsize Enterprises to improve the daily work productivity and customer-service goals – customer retention and growing the business. You do not need to scan or take pictures of every individual paper receipt you have just to submit on your online accounting system. Emailing receipts is much easier and quicker. With just one click of the button, you see great work development every day as many accounting systems today are smarter to recognize every receipt saved in the cloud which makes it simpler to categorize every expense.

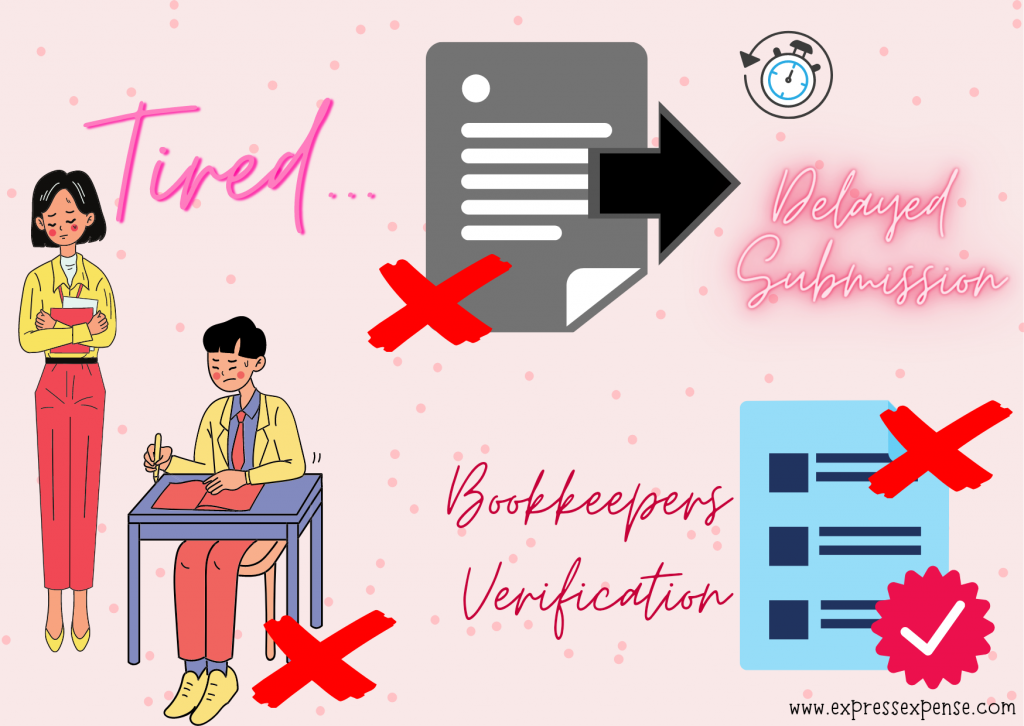

Some companies still use the traditional method – the usual way of organizing and keeping data is using paper-based accounting systems or spreadsheet-based methods. Paper receipt management has found an impact on business operations and produces more wasted time and opportunity such as:

- employees find it to be tiring and a burden because of the repetitive boring process

- submission of expenses reports is getting delayed due to some employees waiting to reimburse their money spent on buying or paying company expenses

- Bookkeepers have to verify every transaction if the amount spent matches the amount that is given on the receipt

It is fine to use the old process but many companies today are no longer required to save paper receipts. With digital use, you can print it if anytime you need it for the records. Yes! everything is saved in the system for later retrieval purposes. Whether you need daily, weekly, monthly, quarterly, or yearly reports to monitor your company’s financial performance, everything is handy, particularly during tax season.

Keeping a receipt is crucial to prove the transactions were made. No receipt, no transaction, no documentation. One of the most significant features of business accounting is saving all the receipts and accurately document every money spent in your company. Through these, you get to define your business activities as:

- provable

- transparent

- understandable

- logical

Managing your receipts digitally plus an online-based accounting system centralizes all your business financial management which helps you to access your financial reports anytime, anywhere. Whether it be auditing or administering tasks such as:

- financial management

- inventory management

- payroll

- receipt or invoicing

- customer relationship management

- employee relationship management

everything is accessible and productive, as it speeds up the entire process. The quality of work results and efficiency of employees is commendable.