A tax audit is an examination of your accounts and financial data by an IRS agent or state auditor to make sure you accurately reported your income, expenses, and credits as per tax laws. You must keep all your tax-related documents for at least three to seven years from the date you filed your return. Keep your receipts in one place for easy access and quicker arranging of all your needed records for future audit reference. Collecting receipts is a crucial part of the preparation method for filing taxes and it is a big advantage if you are always prepared and already set your expectations when the tax audit happened.

Small-Business Owner/Self-employed Receipts

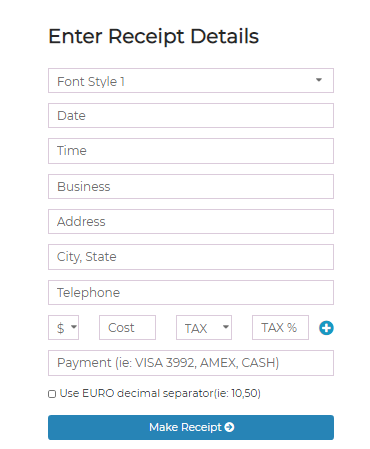

Self-employed individuals should consider using accounting software like Quickbooks, or online receipt makers like ExpressExpense, or invoice receipt makers like InvoiceWriter.

The audit can flow smoothly when the IRS agent or auditor discovers that all the needed documents or records are being presented in an organized manner.

Here are the records to keep:

- Sales slips

- Paid bills

- Invoices

- Receipts

- Deposit slips

- Canceled checks

You have to arrange them by year and type of income or expense for faster identification. These documents support the entries in your books and on your tax return.

Keep your gross receipts as it shows the income you receive from your business. Gross receipts documents are:

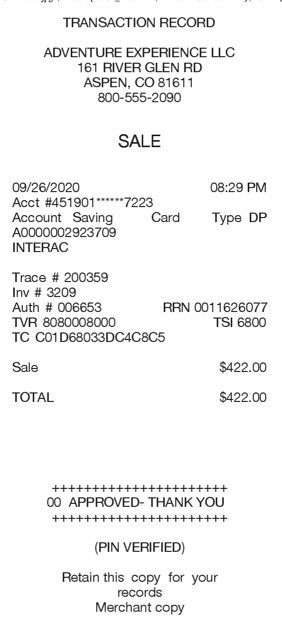

- Cash register tapes

- Deposit information (cash and credit sales)

- Receipt books

- Invoices

- Form 1099-MISC

For business purchases, these are the things you buy and resell to consumers. And here are the documents to keep:

- Canceled checks or other records reflecting proof of payment/electronic funds transferred

- Cash register tape receipts

- Credit card receipts and statements

- Invoices

NOTE: Supporting documents are needed to present to sustain the purchase transactions.

Business Expense Receipts

Business expenses are the costs you acquire (other than purchases) to carry on your business.

These are the documents for expenses:

- Canceled checks

- Cash register tape receipts

- Account statements

- Credit card receipts and statements

- Petty cash slips

- Invoices

NOTE: Supporting documents are needed to present to sustain the purchase transactions.

Other records that you need to save are:

- Travel, Transportation, Entertainment, and Gift Expenses. For more details, you can check the publications regarding this matter.

- Assets. These are the resources, such as machinery, furniture, or any equipment you own and use in your business operations.

- Employment Taxes. You may read the Employment Tax Recordkeeping and the About Publication 15, (Circular E), Employer’s Tax Guide for more details. You also keep all records of employment for at least four years for future reference.

Receipts can aid you in two ways:

- maximize your refund,

- or at least minimize your tax difficulty.

You can also ask for guidance from a tax professional for a more thorough understanding of collecting and keeping tax records and receipts if you think you need to be more educated about tax matters. Make sure that you are doing a productive task of storing and maintaining records to avoid future problems.

To know more about ExpressExpense receipt generator you can visit our FAQ’s page or SIGN-UP today and start saving all the useful receipts you needed for future tax claims purposes.