Here is a great breakdown from an expert in expense reimbursement on as and when to use your own generated receipts.

Simply put – ask your Accounts Payable manager if they are okay with a replacement receipt before you submit.

The ‘rules’ for submitting receipts differ from company to company. As a matter of paper control, most companies would prefer or insist upon having an original receipt. This mitigates the risk of an employee getting reimbursed twice (or more) for a specific out-of-pocket expense.

It is not a matter of trusting the employee. It is a matter of paper control and sound accounting procedures.

However, financial management recognizes that ‘shit happens’ from time to time and I would imagine most companies will be forgiving for a ‘once-in-a-blue-moon’ type situation such as this.

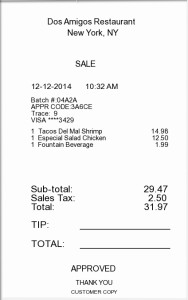

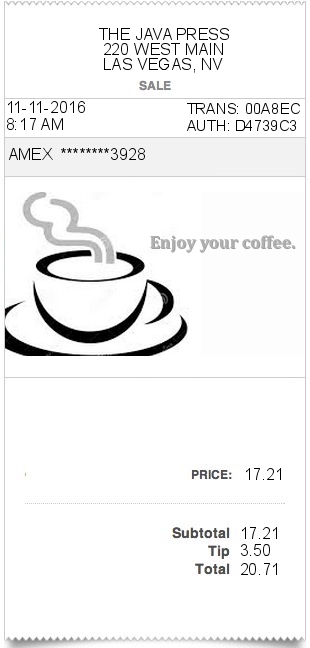

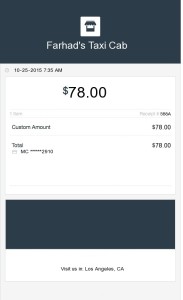

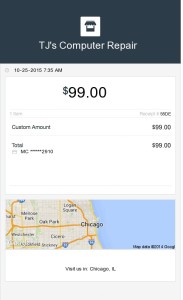

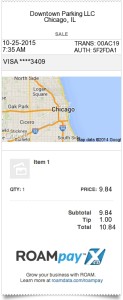

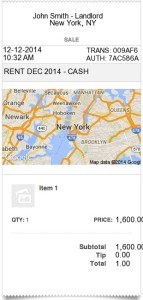

If in doubt, check with your company’s Accounts Payable Manager or Controller to determine the criteria for proper supporting documentation. If they allow you to submit a custom generated receipt of your own – then go ahead and use a service like ExpressExpense.com.